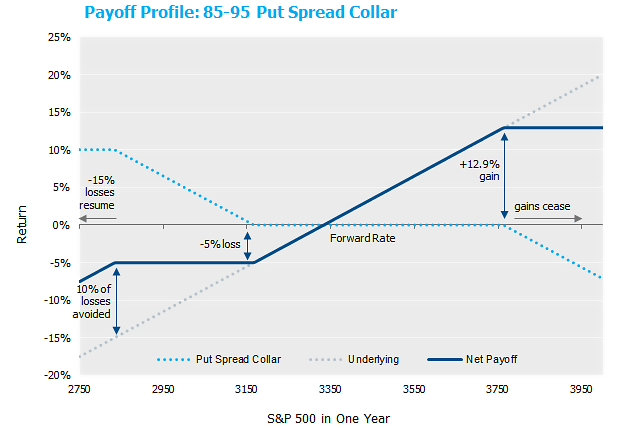

Willing to Concede the S&P at 3750+? Equity Protection Strategies, Enter Stage Left - NISA Investment Advisors, LLC.

Sergei Perfiliev 🇺🇦 on Twitter: "The strategy was eventually rolled to 3440/4080/4450 strikes, with the same OI of ~45,000 contracts. This can be seen in the 31 December 2021 option chain: https://t.co/QZ30HVTjy2" / Twitter